International opportunities : Agtech development on the Australian Agricultural Market

“A market with many AgTech opportunities”

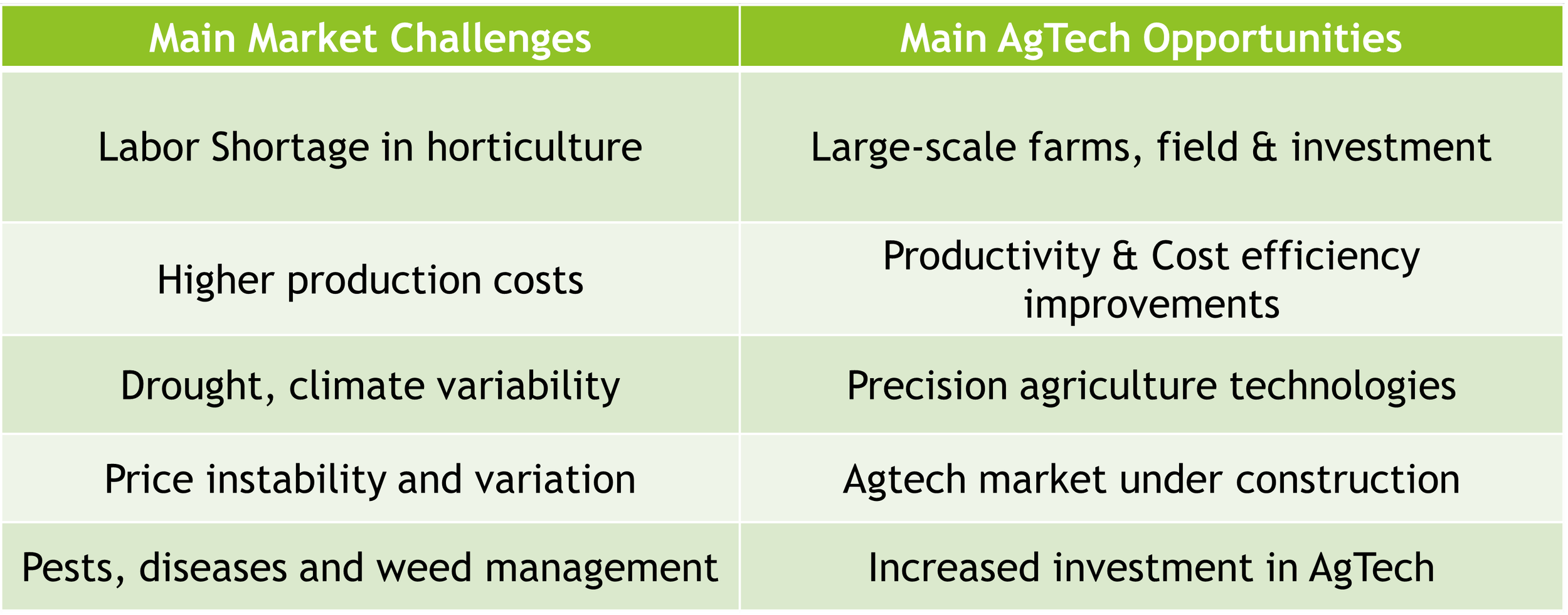

After studying the USA market and Canadian Market, let's see what's happening on the other side of the world with Australia market. Australian agriculture is an important sector for the country's economy, both historically and in the structure of its foreign trade. Employing over 325,000 people in agriculture and related services, it accounts for approximately 3% of Australia's GNP. Australia has approximately 60,000 agricultural and pastoral farms. The lack of water is the main limiting factor for agricultural production. Other limiting factors are soil quality (fragile, mineral-poor, non-fertile soils, etc.) and difficult terrain.

Today, we are going to get closer to this market and estimate its size, its behavior and its evolution. In particular, we will see its main markets, its farm size, and the various opportunities that this market offers to new technologies.

Photo from Walter Kihm

Australia farming : Challenge and opportunities for agtech

Helping AgTech companies to build the agriculture of tomorrow

Australian MARKET SIZE

Nothing better than a few figures to understand how big and diversify is the Australian market:

🥦+ 100,000 ha of vegetables growing

🍇+ 135,000 ha of wine growing

🍏+ 175,000 ha of orchards growing

🍓+ 6000 ha of berries growing

🌽+ 22,000,000 ha of field crops growing

🍅+ 20,000,000 m² of greenhouses

🌱 - 500,000 ha in organic production

Evolution of Australian Farms

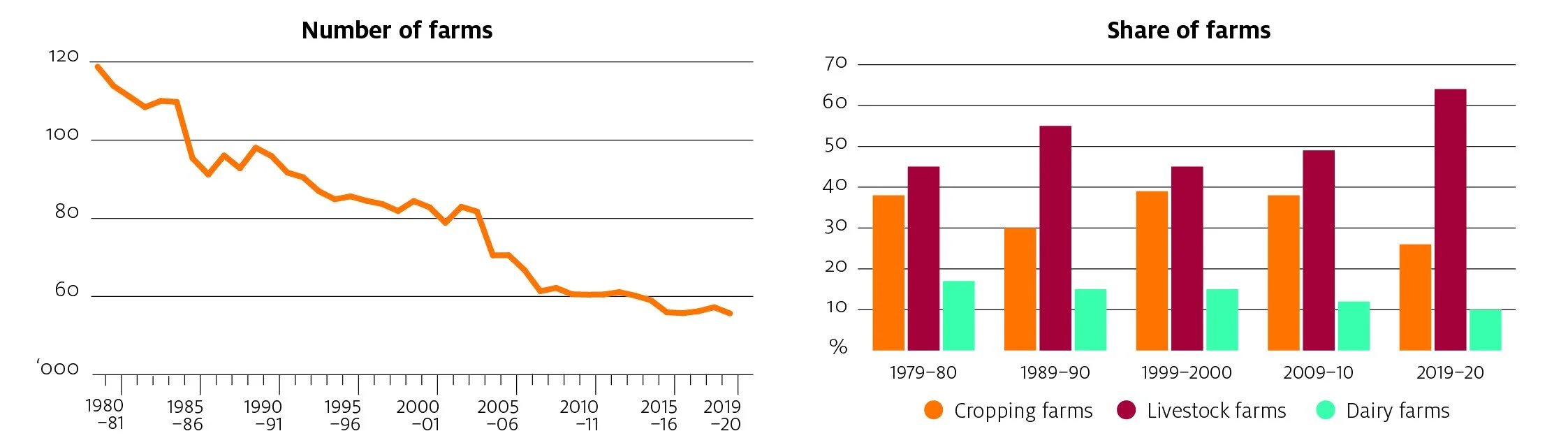

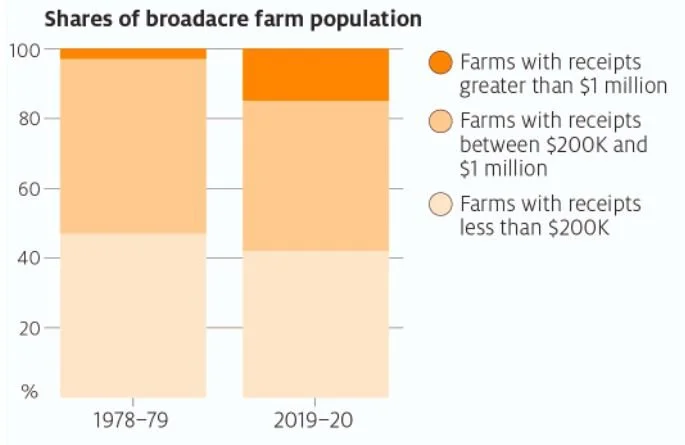

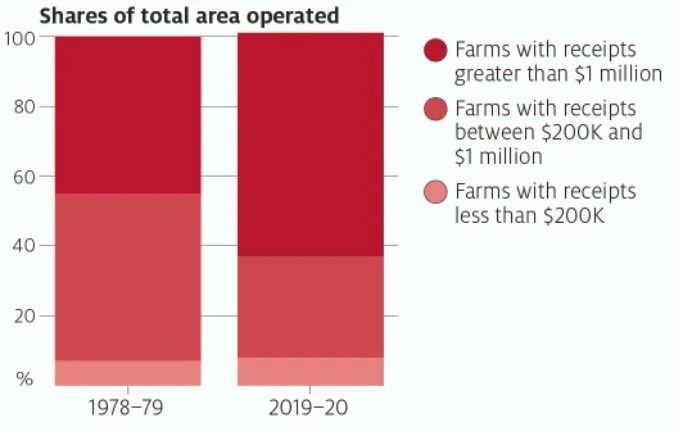

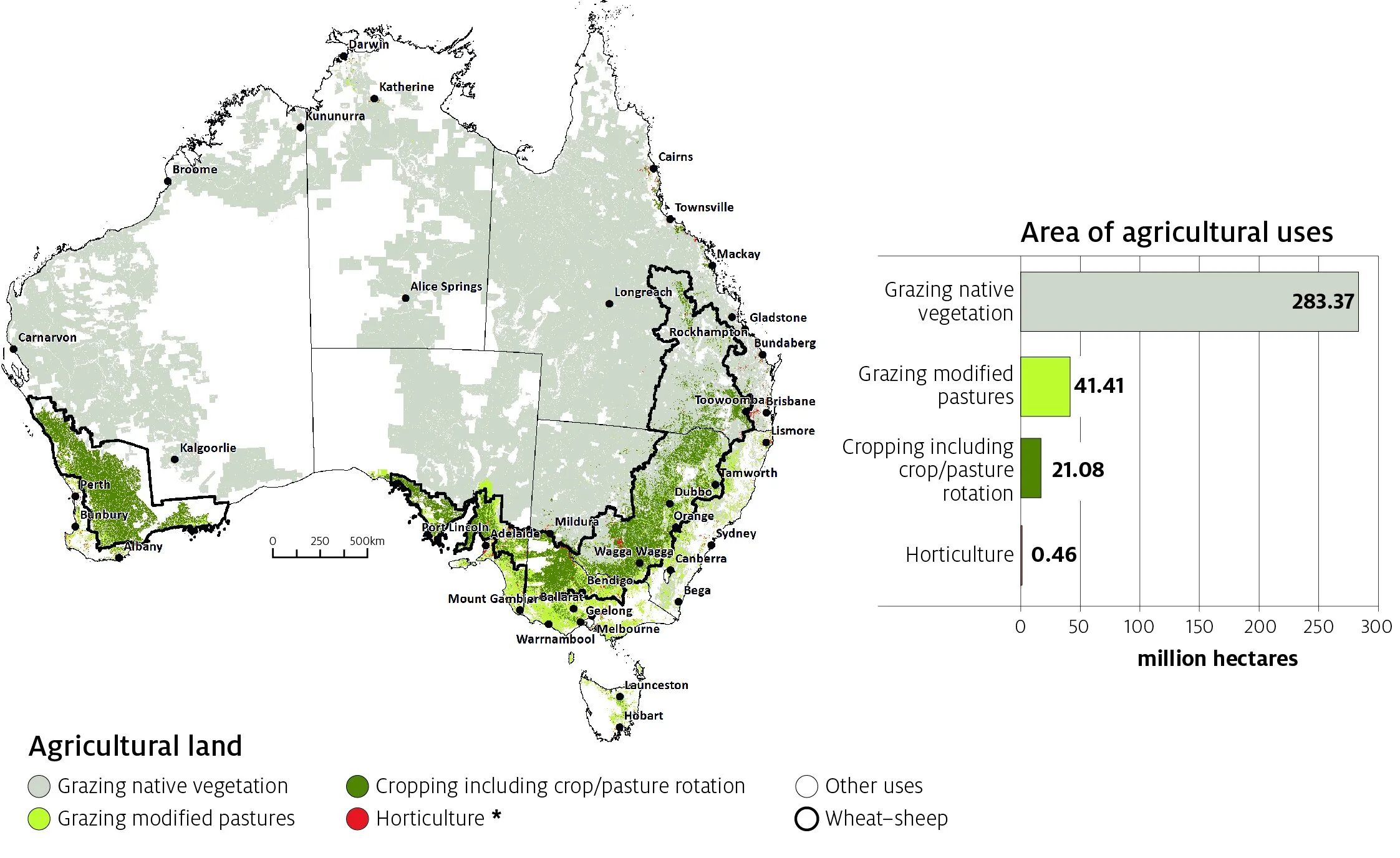

It is not for nothing that Australia is known for the immensity of its farm operations. With around 60,000 farms and 370,000,000 hectares of land dedicated to agricultural production, Australia has an average of almost 6000 hectares per farm, 12 times bigger Canadian Farms.

Evolution of the number of farms per commodity

In more than 30 years, the number of farms has been divided by 2 ! In 2020, Livestock and dairy farm represent 75% of the Australian farms. Cropping farms have gone from 38% to 25% in 30 years.

Despite a decrease in the number of farms in Australia, the number of hectares cultivated remained unchanged.

Australia has always been a land where large farms predominate. With time, we see that the phenomenon is accelerating. The trend shows that it is not the small farms that are expanding, but rather the medium-sized ones that are expanding or being taken over. The whole farms operations seems to tend towards 2 typical profiles, the gigantic ones and the small ones.

Water saving, A big opportunity for Agtech

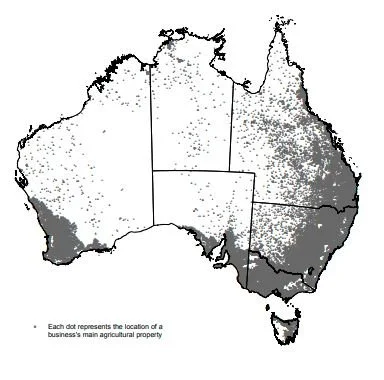

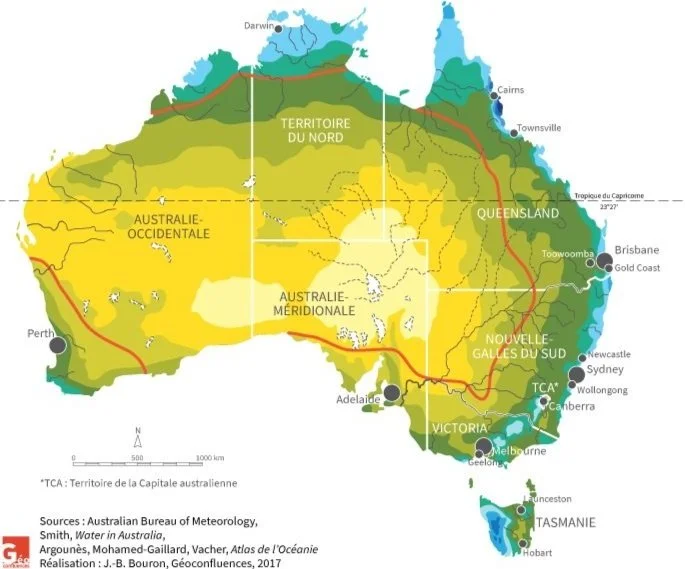

The lack of water is the main limiting factor for agricultural production in Australia. It is therefore not surprising to find a concentration of farms in regions with higher rainfall.

Australian Farms Location

In red, the limitation of the arridity

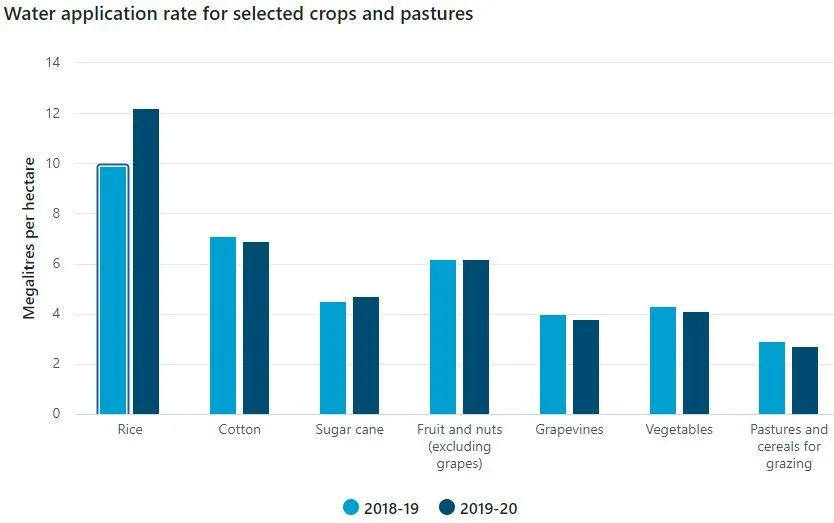

In terms of water consumption per crop, the more water-intensive a crop is, the greater the fluctuation in production during dry seasons.

Water use per commodity

The Australian market is constantly looking for better irrigation systems and irrigation management systems, a big opportunity for management systems and different water sensors

Case of the MURRAY DARLING BASIN

The Murray Darling Basin

Half of Australia's total water used for irrigation was within the Murray Darling Basin region where there was:

2.7 million megalitres of water applied

701,000 hectares of agricultural land irrigated

Fruit and nut trees, pastures for grazing and grapevines used 61% of the water applied in this region:

Labour shortage, the other opportunity for agtech

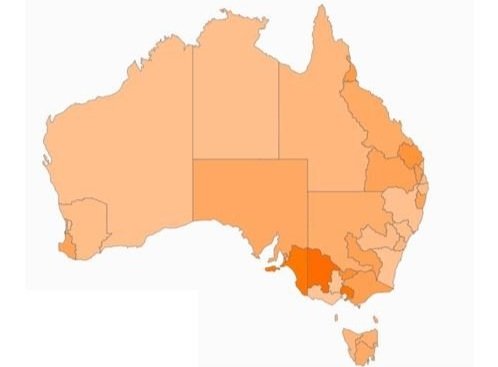

Labour is a key input to Australian agriculture, and understanding it is really important. 325,000 people on average are employed in Australian farms, with the horticulture (43%) and broadacre (49%), with livestock and cropping, industries accounting for the vast majority of workers, dairy farms represent only 8%.

Geographic area with the most farm employment

Distribution of Farm employee per sector

the Horticulture labour

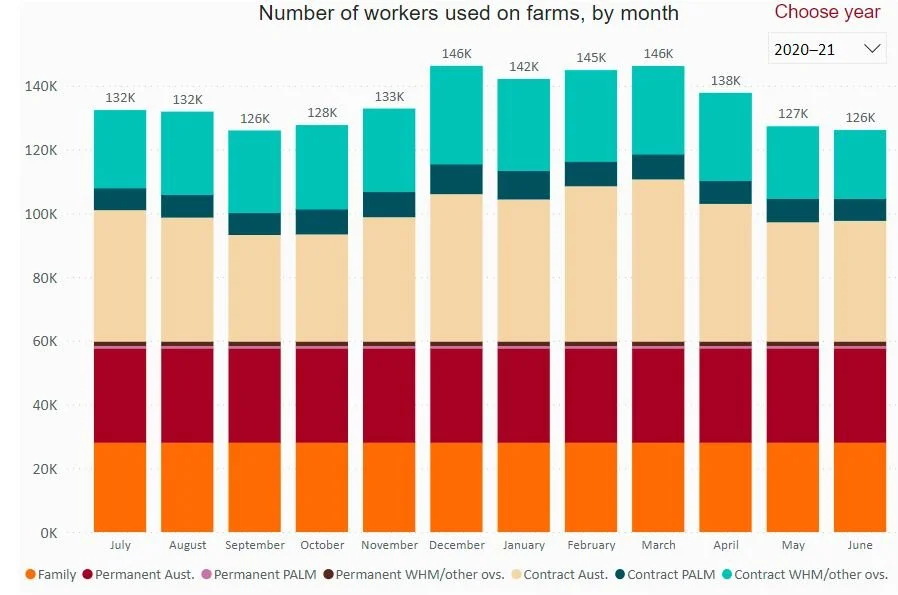

With an average of 135,000 workers per month, Horticulture sector is the second sector to employ in farming. With peaks of 150,000 workers between December and January, it is difficult for this sector to find enough Australian labour and turns to foreign labour to ensure the continuity of its production.

Distribution of the workforce in Horticulture sector

the covid crisis, an accelerator

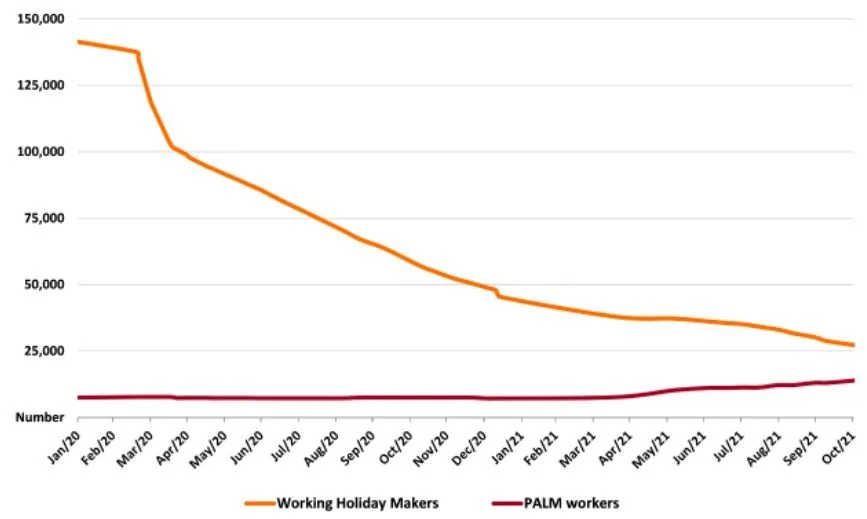

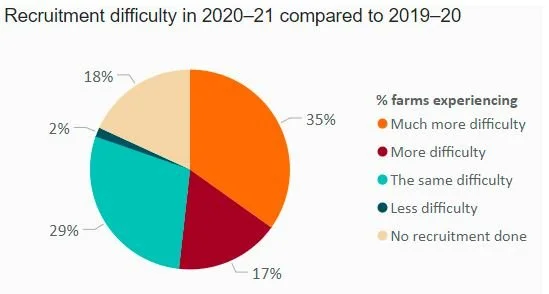

The restrictions imposed by Federal, State and Territory Governments to limit the spread of COVID-19 have had different labour market impacts across demographic groups, industries and regions. The effects of COVID-19 on the Australian agricultural workforce have been most directly felt in the horticulture sector.

Evolution of the number of workers on working vacation contracts

With COVID, many farmers faced labour shortage quickly after the beginning of the crisis. Workers from overseas are an important source of labour at peak period. In order to ensure their production and harvest, many of them had to increase the wages by 10-20%.

With this crisis, Australian farmers have seen the limits of the Australian farming labour system. And even if the borders are gradually reopening, these two last seasons will have left a mark, offering the opportunity of development for agricultural robotics in the horticultural market.

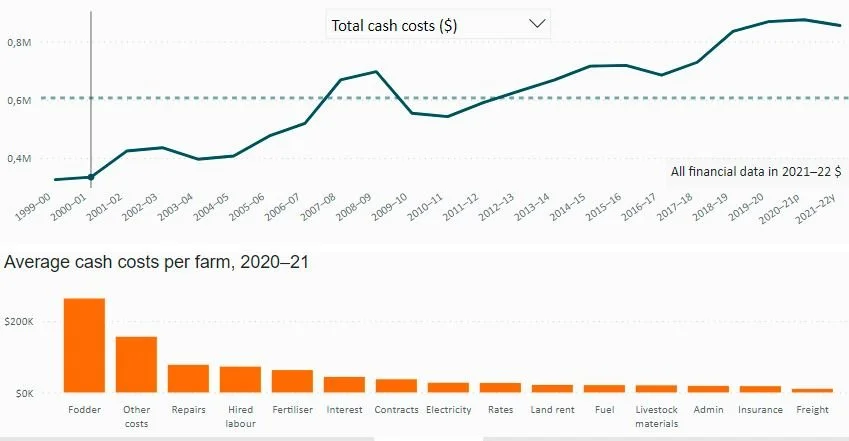

Evolution of the AUstrlian Farms costs

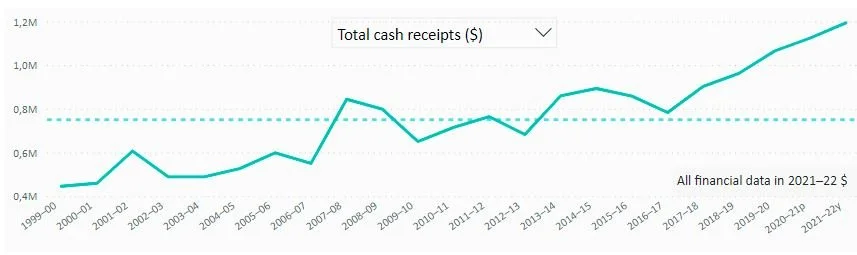

For Australia as a whole, average farm cash income for all broadacre farms is projected to increase by 34% in 2022—from $208,000 per farm in 2021 to $278,000 per farm in 2022. If these revenues are increasing, it is because of good seasonal conditions and higher commodity prices in 2022.

Global evolution of the Australian farms’s cash receipts

On the other hand, the production costs are also increasing rapidly. This increase is manly driven by higher prices for fertilisers and fuel, but also due to the increase in the cost of labor.

Global evolution of the cash costs for Australian Farms

Historically, Australian farms have always received little help from the government. This means that over the decades, they have had to evolve to remain productive, competitive and meet the needs of the markets they supply.

average budget of horticultural farms

In Conclusion

As seen with USA market and Canadian Market, Australian market is constantly evolving with innovative solutions to improve and sustain their farm operations. Whether it is drones, sensors, robotics, autonomous tractors or spot spraying systems, the Australia is an market opportunity for any AgTech technology that can improve the profitability of its operations.

The Australian market interests you ? Would you like to have a targeted, relevant and customized analysis ? Would you like to have a feedback on your technology, from customers, product and field experts ?

Overview of the Australian Agricultural Market

WANT TO LEARN MORE ABOUT OTHER MARKETS AND AGTECH OPPORTUNITIES ?

AMERICAN MARKET - 🇺🇸

AUSTRALIAN MARKET - 🇦🇺

CALIFORNIAN MARKET - 🇺🇸

CANADIAN MARKET - 🇨🇦

EUROPEAN MARKET - 🇪🇺

FRENCH MARKET - 🇫🇷