International opportunities : AGTECH opportunities ON THE CANADIAN AGRICULTURAL MARKETs

“A rapidly evolving market.”

After studying the USA market, it was only natural to look at what was happening on the other side of the border, in its neighboring country, Canada. Not surprisingly, there are similarities between the two markets, even if the Canadian market has its own specificities. Today, we are going to get to the center of this market to estimate its size, its behavior and its evolution. In particular, we will discuss its main market, which is focused on field crops, its farms size, its machinery and the various opportunities that this market offers.

Canadian farming : Challenges and opportunities for AgTECH

Helping AgTech companies to build the agriculture of tomorrow

canadian agricultural markets in numbers

Nothing better than a few figures to understand how field crops dominate the Canada market:

🥦+ 100,000 ha of vegetables growing

🍇+ 13,000 ha of wine growing

🍏+ 25,000 ha of orchards growing

🍓+ 100,000 ha of berries growing

🌽+ 31,000,000 ha of field crops growing

🍅+ 17,000,000 m² of greenhouses

🌱- 500,000 ha in organic production

↓ More figures and details on crop types by category in this report ↓

Evolutions of the Canadian farms

In a little more than 20 years, the number of farmers in Canada has decreased by 30%. Going from 270,000 farms in 1996 to only 193,000 in 2016.

On the other hand, the agricultural surfaces have only increased. On this graph, we can see that despite the decrease in the number of farms, the number of very small farms and the number of large farms has hardly changed or even increased. Rather, it is the number of small and medium-sized farms, between 4 and 895 ha, that has fallen.

This trend of enlargement of farms and decrease of farms has no reason to stop in the next years, forcing the Canadian market to invest in larger and more sophisticated machines.

Focus on the field crop market

With 31,000,000 ha distributed around 60,000 farms, Canada has an average area of 500 ha per farm, almost 3 times higher than the average hectares per American farms. Since 30 years, the agricultural surface dedicated to field crops has increased by 44% while the number of farm has significantly dropped.

To meet global demand, farms have diversified their production, especially through the use of genetically modified seeds, which can acclimatize more easily to the Canadian market conditions.

A diversify field crop area

In more then 30 years, the total area production has increased about 44%. If the production of spring wheat and barley has decreased by about 40%, the production of other crops like lentils, canola or soybeans has explode.

Distribution of production by region

Geographically, the production is very concentrated. Saskatchewan and Alberta regions share almost 75% of the total production.

Agricultural Machinery and Equipment

We have seen the importance of the North American agricultural machinery in a previous article on the American market. North America represents 21% of the world agricultural machinery market. And even if the Canadian market is smaller, it remains a key market on the continent.

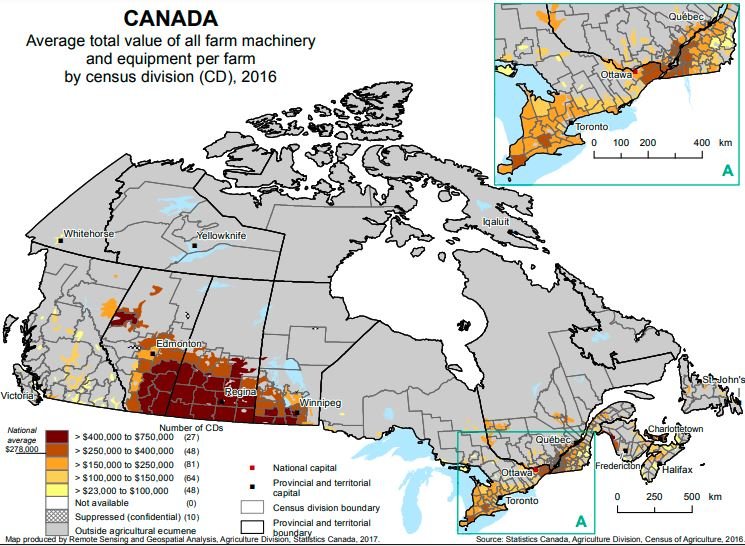

With farms getting larger and the number employees decreasing every year, Canadian farmers have no choice but to invest in a larger and more sophisticated fleet. In 2016, the total value of agricultural equipment owned and leased by farms in Canada equaled more than US$33 billion. This represents an average value per farm of US$180 000.

Concerning the region where the biggest investments are done, once again no surprise, we find the big field crop producing regions. Due to their evolution, these regions have a high demand for more efficient, larger and more powerful equipment.

Opportunities for AGTECH technologies

Like its American neighbor, the Canadian market is driven by productivity and competitivinesss, and the opportunities that arise from them. The history of Canadian agriculture and the evolution of their farms show that Canadian farmers are used to evolving. By studying imports of equipment, they know how to seize the opportunities offered by innovation to improve yields and competitiveness.

Canada’s agriculture is highly mechanized and capital-intensive, so precision agricultural technology is in high demand.

With the decrease in the number of employees willing to work on the farms, the pressure related to the lack of labour is also felt. For the field crop market and in view of the vastness of the farms, this could give way to the development of autonomous tractors on the market in the near future. For the robotics solutions, the market seems attractive and targeted to me even if it seems to be quite limited in size.

Another opportunity caught my eye, Canada is the 4th largest consumer of pesticides in the world. Due to the vastness of these agricultural lands, Canada has a low average use of 2.4 L of pesticides / ha. However, in my opinion, there is a good opportunity for spot spraying solutions in field crops. Knowing that herbicides represent almost 80% of the total consumption of this market, I see there a good opportunity to make great savings for farmers and for the planet.

IN CONCLUSION

During this general study of the Canadian market, I found many similarities with what I had studied of the American market. Despite these similarities, there are still characteristics that are specific to this market. Even if this market is smaller, Canadian market is fast moving and less consolidated than the US market.

The Canadian market interests you ? Would you like to have a more relevant and customized analysis ? Would you like to have a feedback on your technology, from customers, product and field perspective ?

Want to learn more about other markets and AgTech Opportunities ?

AMERICAN MARKET - 🇺🇸

AUSTRALIAN MARKET - 🇦🇺

CALIFORNIAN MARKET - 🇺🇸

CANADIAN MARKET - 🇨🇦

EUROPEAN MARKET - 🇪🇺

FRENCH MARKET - 🇫🇷