French Agricultural Markets : AgTech opportunities

“A market that wants to regain its competitive edge through innovation and sustainability. ”

A year ago, I highlighted the opportunities in the European market. Now it's time to tackle, in six keys points, the European agricultural market with the greatest potential, France.

Harvest on the family farm 2023, YouTube Video

Founded in 2022, AgTech Market specializes in bridging the gap between agricultural innovation and real-world application. We help agricultural machinery manufacturers adapt to evolving AgTech trends by providing tailored support, from market analysis to product development and go-to-market strategies. Our mission is to make AgTech solutions accessible and effective, driving the adoption of technologies that truly meet the needs of farmers and manufacturers alike.

French market : Challenge and opportunities for agtech

↓ Download the full French market report here for FREE ↓

The French agricultural markets, challenges & opportunities

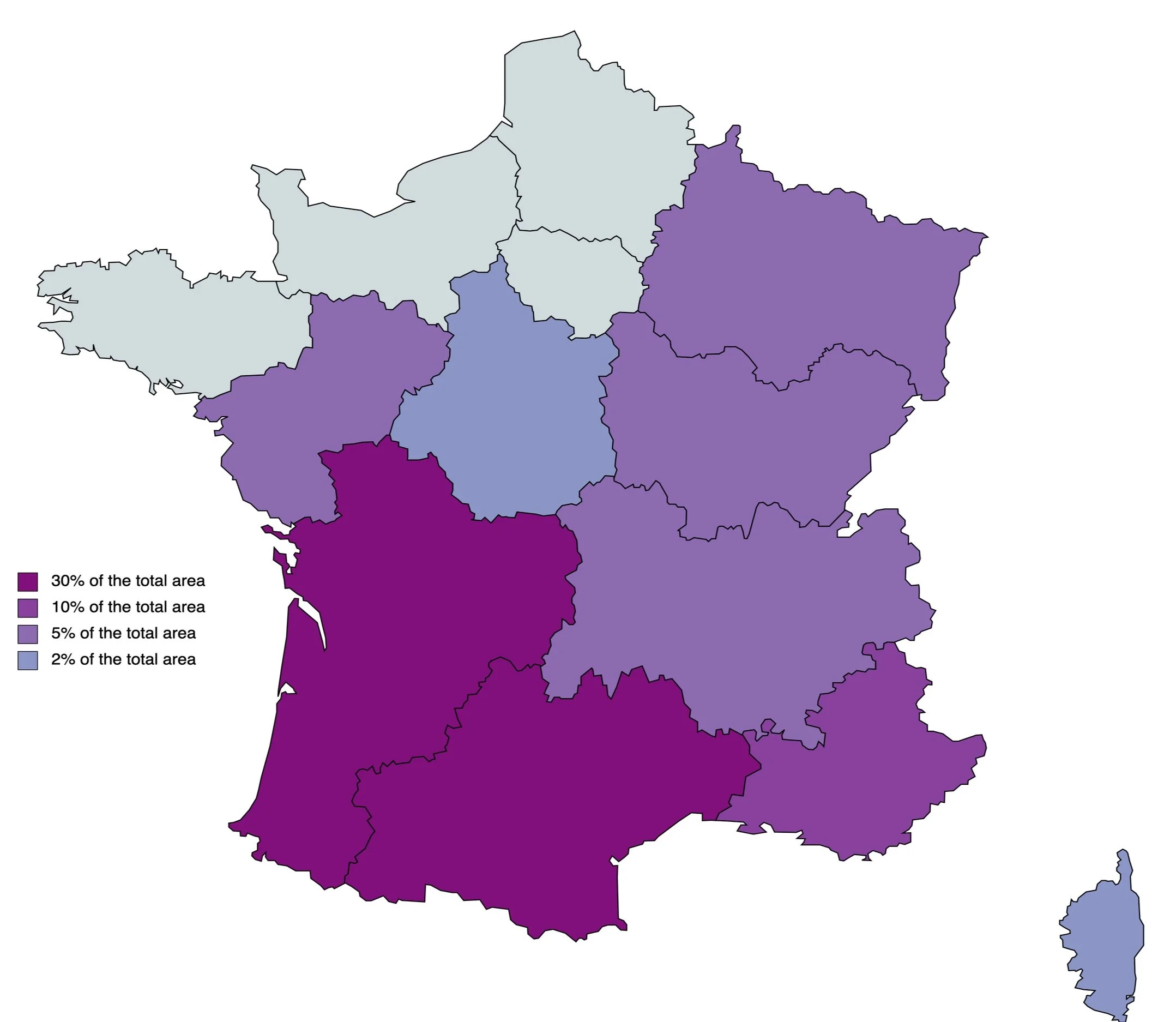

Europe's largest market by area

Nothing better than a few figures to have a good overview of the market :

🌽+ 16,000,000 ha of field crops growing, 1st in EU

🍇+ 800,000 ha of wine growing, 2nd Ww

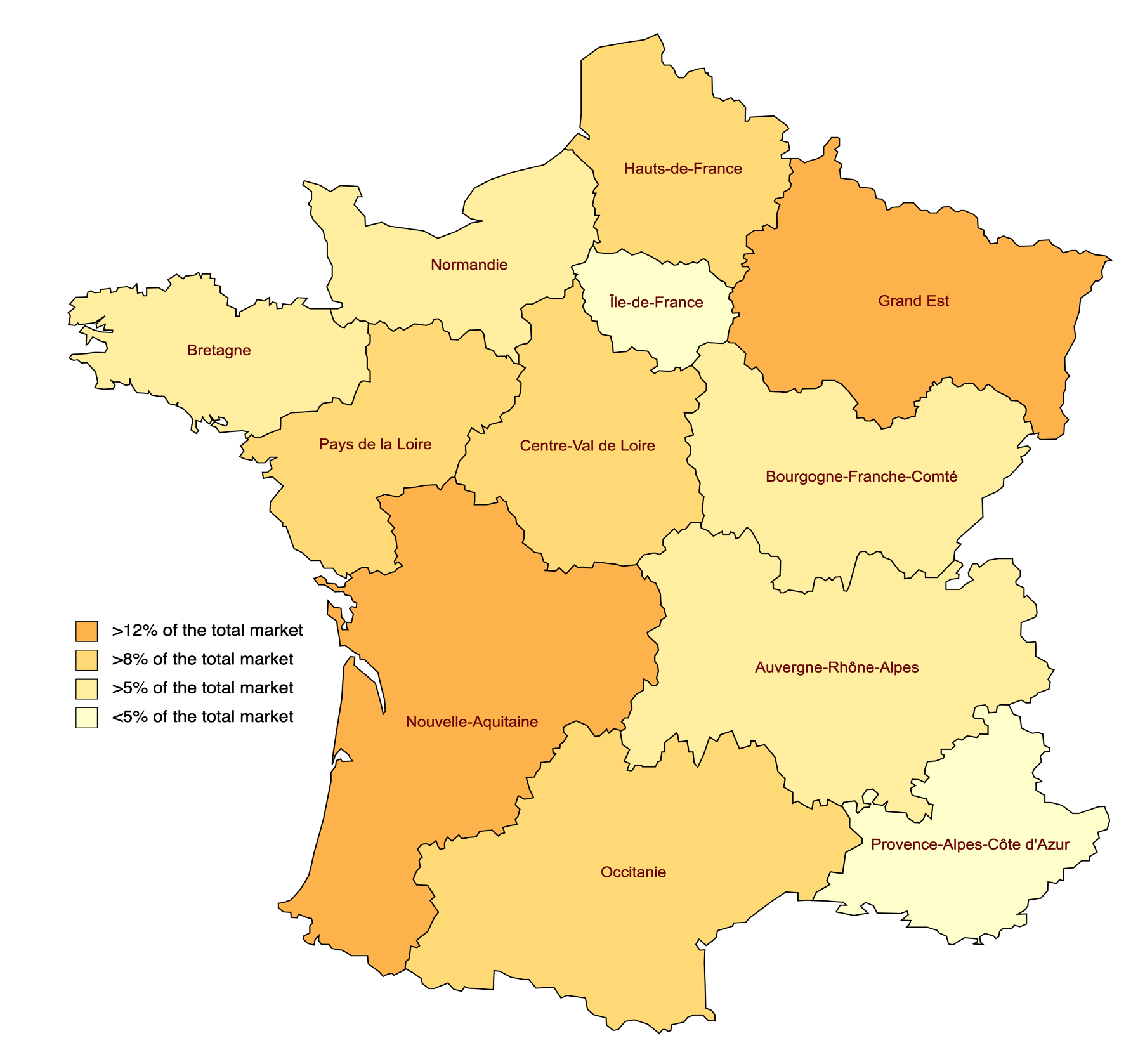

EU leader in ag equipment sales

A market is relatively stable overall

In 2022, the agricultural equipment market will be worth 9.5 billion euros, with the largest share of sales generated by the 40 000 tractors sold. However, certain categories of agricultural equipment are booming, with double-digit increases.

« Source : Rapport économique 2023 - AXEMA »

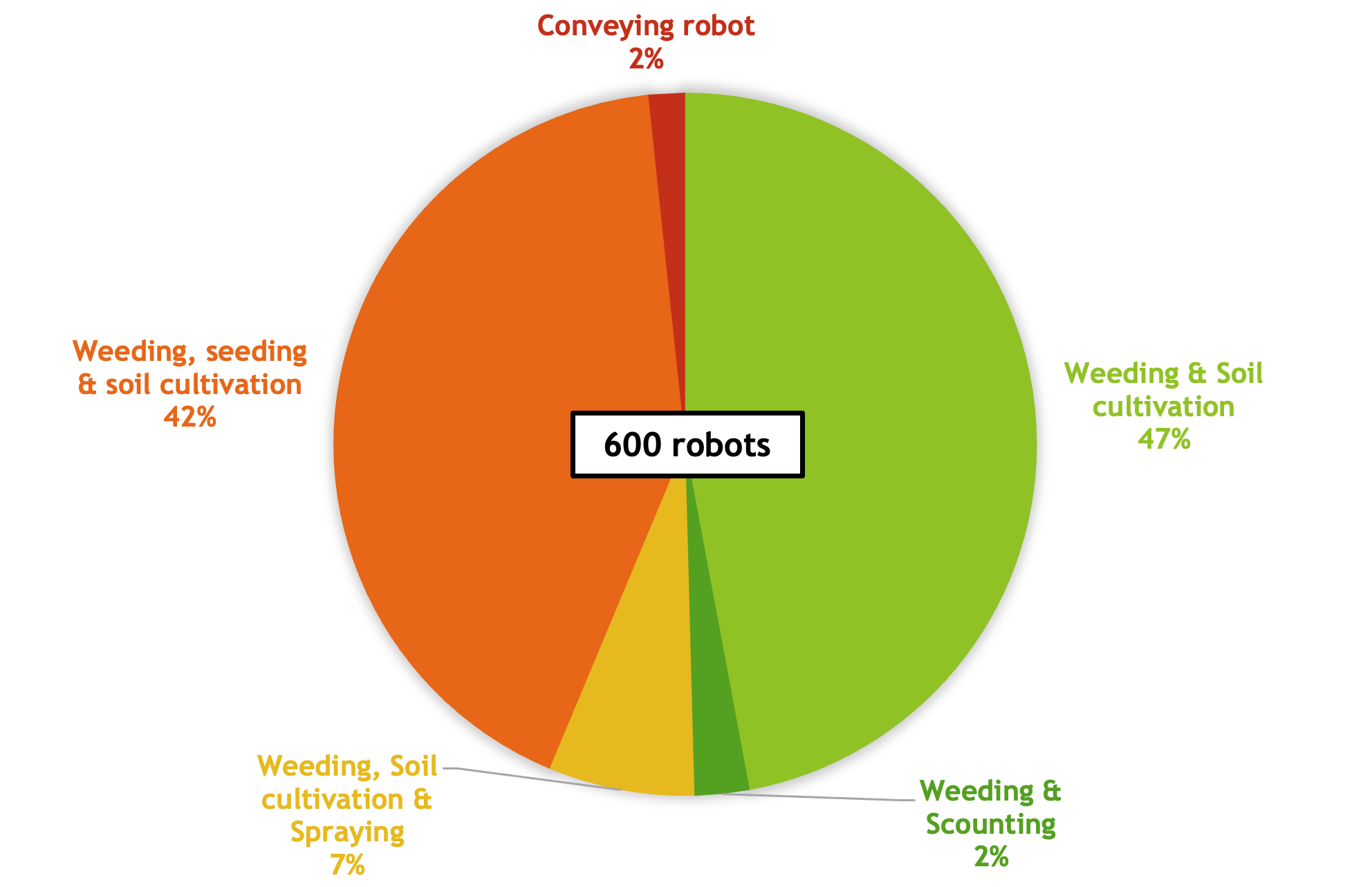

Robots conquer farms

« Source : Rapport économique 2022 - AXEMA »

In 2018, 100 outdoor robots used to roam the fields; today, by the end of 2023, there will be over 600. 100 outdoor robots used to roam the fields; today, by the end of 2023, there will be over 600, +500% in 5 years.

In 2022, 1 250 new milking robots have been sold, +18% vs 2021. These robots have already reached 30% of the market and will continue to grow over the next few years until they become commonplace.

As for robotic mowers, 90,000 new ones were sold in 2022, representing 10% of the mowing market in terms of units.

But what explains such enthusiasm for robotics and new technologies ? A changing farm model and societal pressure to reduce inputs.

Farms undergoing radical change

Unlike other markets studied in the past, French agriculture has always been based on a family farm model. A majority of small to medium farms averaging 80 hectares, with a manager who takes care of the work and the family there to help. But due to a lack of farmers, manpower and profitability, this model is in the throes of change.

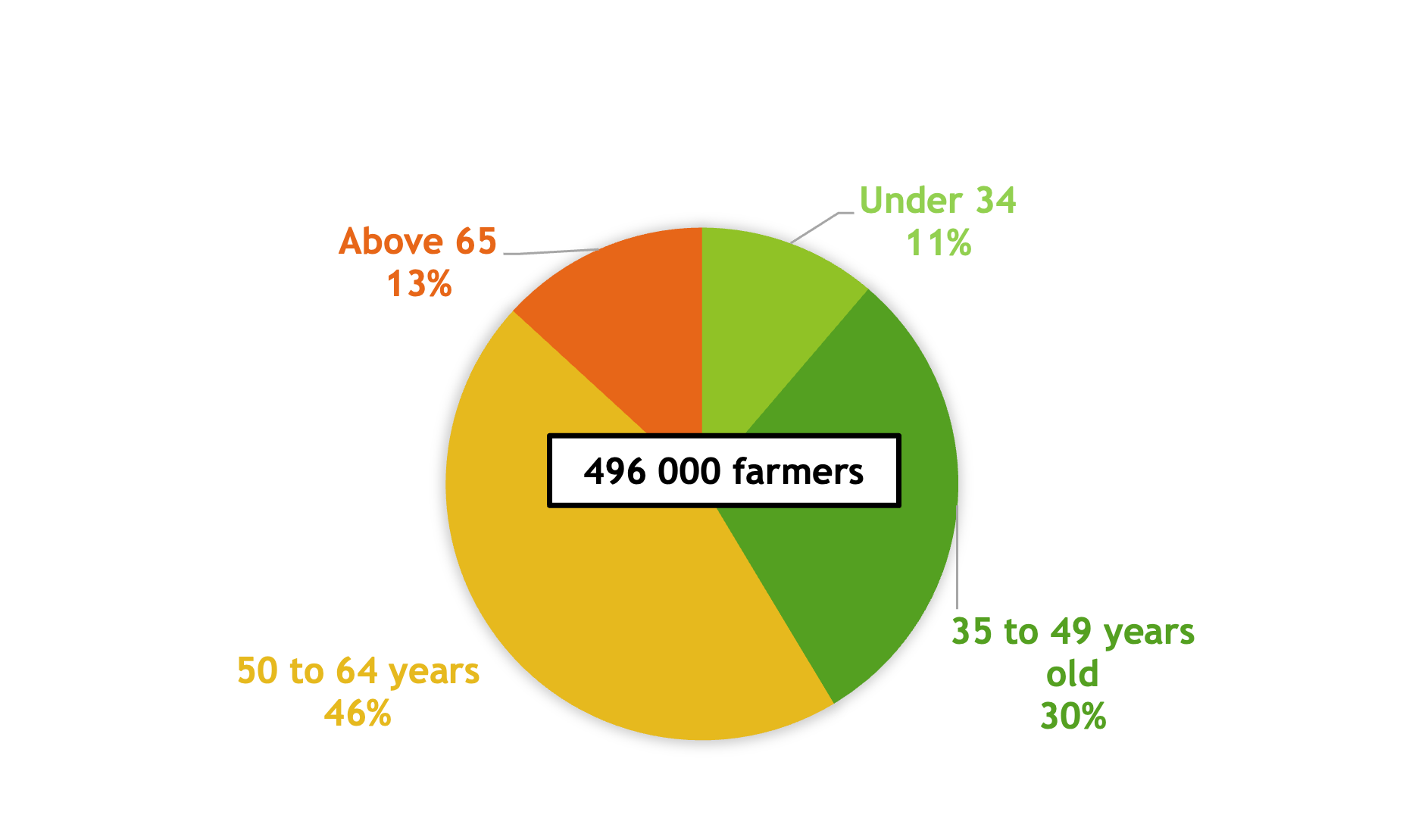

One installation for every 3 retirements

In 10 years, France has already lost 20% of its farmers, and it's not over yet. In the next 15 years, 59% of the farming population is due to retire. What does this mean? Farms will expand, farmers will group together and they'll have to equip themselves with more efficient machinery to be able to do the same work with less labor.

Increasingly scarce and expensive labor

The agricultural workforce has shrunk by 10% over the past 10 years. With a loss of 40%, it is the family employees who have declined the most. As for permanent employees, the only category of employment to have increased, by 8%, boosted in particular by the development of contractors and CUMAS (cooperatives).

leading the world organic production, but at what price?

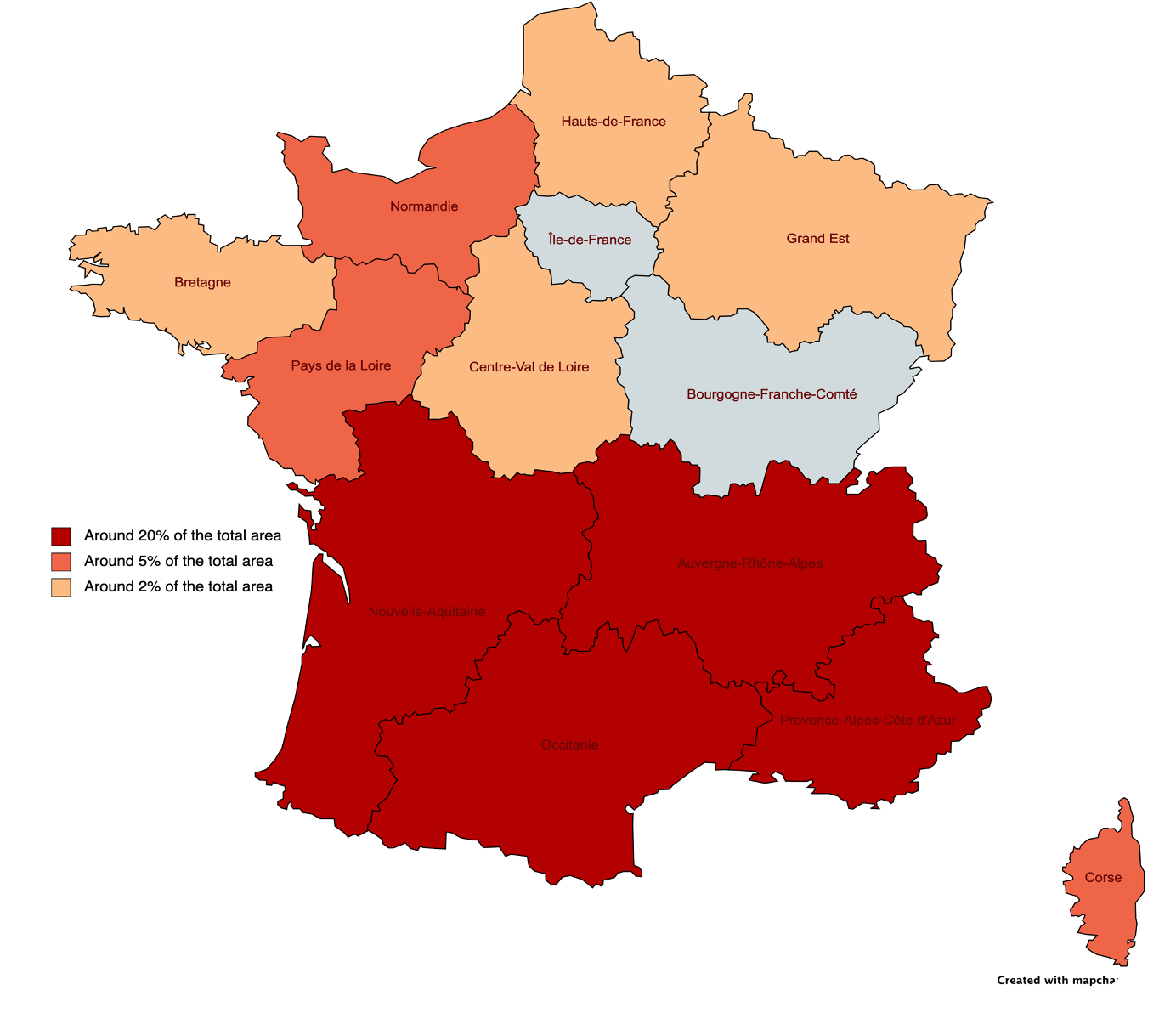

It's no longer a surprise that organic production has been booming for over 10 years in Europe and France. This change in production is driven by consumer demand for healthier products. But it is also driven by the political system, which, through the distribution of grants, is pushing farmers to review their production model.

This “society” pressure is driving farmers to adopt more sustainable practices, and to actively seek out innovative technologies such as organic farming methods, biocontrol solutions and intelligent crop management techniques. And farmers of all market are playing the game, as the figures show:

🌾 10% of field crops grown in organic - 🍇 20% of the vineyards grown in organic - 🥬 11% of the vegetables grown in organic - 🍎 35% of the tree crops grown in organic

This in turn fosters the emergence of environmentally-friendly technologies. The most eagerly awaited technologies, across all markets, are all the alternative technologies for managing weeds, parasites and fungi. And it's not for nothing that local manufacturers and importers are positioning themselves primarily in these niches.

Oz Naïo user experience, 2022

By 2030, Europe aims to significantly reduce the use of plant protection products, at least 50% less, to promote more sustainable agricultural practices. Massive investment in research and development is planned to promote innovative, environmentally-friendly solutions, while guaranteeing food safety and environmental protection. The ultimate goal is to create a balance between agricultural productivity, the preservation of biodiversity and public health, by transforming the agricultural landscape towards a more ecosystem-friendly approach.

Europe's most subsidized agriculture

French agriculture receives considerable support through various subsidy and financial support mechanisms. These subsidies come mainly from the European Union's Common Agricultural Policy (CAP), which accounts for a significant proportion of the French agricultural budget. They are allocated for a variety of reasons, including supporting farmers in modernizing their practices (PCAE grants programs), encouraging environmentally-friendly methods or technologies (Plan France Relance), maintaining competitiveness on the world market, and guaranteeing food safety.

At EUROPE level : The Common Agricultural Policy (CAP)

Farmers generally receive income support based on their farm’s size in hectares. All EU countries have to offer a basic payment, a payment for sustainable farming methods and a payment for young farmers.

Additionally, EU countries can choose to offer other payments that focus on specific sectors or types of farming, like organic. There are specific schemes designed to help small and medium sized farms, young farmers, farmers who operate in areas of natural constraint and/or sectors undergoing difficulties.

At a national level : Developing the 3rd agricultural revolution

The plan encourages the deployment of cutting-edge technologies such as digital farming, sensors, robotics and artificial intelligence to improve farm efficiency while reducing the environmental footprint. It also supports the transition to agro-ecological farming models, soil regeneration and the reduction of chemical inputs. By investing in research, training and the adoption of innovative practices, the France Relance plan aims to position French agriculture at the cutting edge of sustainability, responding to current challenges while paving the way for a high-performance agriculture.

These 23 subsidized technologies of the last envelop share a focus on making farming cleaner and more efficient. They achieve this by cutting down on inputs like pesticides (as seen in the Bliss system), adopting eco-friendly motorization (like Vitibot's bakkus), and enhancing farmers' autonomy by optimizing work processes (like Aura from Kuhn).

At a Regional scale : Competitiveness and Sustainable Agriculture Programs (PCAE)

Each regional chamber of agriculture is allocated a budget of several million euros, to offers subsidies to farmers to encourage environmentally-friendly practices, promoting the reduction of chemical inputs, the preservation of natural resources and support for innovative projects. These various funding schemes and complementary subsidies are part of a dynamic aimed at modernizing and greening French agriculture, by meeting the sector's economic, environmental and social challenges.

The machinery subsidized by PCAE grants vary according to region and the specific needs of farmers. However, in general, the machinery and equipment eligible for PCAE subsidies are those that promote environmentally-friendly farming practices. Common examples of machinery subsidized include equipment for :

Precision farming, machines to reduce chemical inputs (like weeders or more efficient sprayers), devices for water management, or equipment for composting and agricultural waste management, machines that promote the use of renewable energies, such as equipment for methanization or solar energy production on farms.

France's agricultural subsidy systems aim to support farmers in adopting sustainable practices, modernizing their farms and promoting innovation to reconcile productivity, environmental protection and economic dynamism. Getting your equipment subsidized is key to maximizing your return on investment and penetrating the market faster.

Production costs that keep rising

The recent rise in production costs in French agriculture can be attributed to several factors. Rising prices for agricultural inputs such as fertilizers, fuels and crop protection products have impacted farmers' expenses. In addition, farm labor costs have also risen, influenced by changes in legislation on wages and working conditions.

Minimum LAbor wage evolution (SMIC)

The gradual increase in the minimum wage and minimum wage costs, directly impacting farms. In addition, legislative reforms have been introduced to guarantee better working conditions for agricultural workers, particularly with regard to overtime, paid leave and safety measures.

In addition, demographic trends, may have exerted upward pressure on labor costs, sometimes leading to higher wages to attract and retain skilled workers. (Photo credit Générale des services)

As for the more indirect reasons, climate change and extreme weather events have led to additional investments in farm adaptation, for example in more efficient irrigation systems or resilient infrastructure. Finally, growing demand for organic foods, high-quality agricultural products has sometimes required investment in new farming practices or specific certifications, thus impacting production costs.

Production costs in organic farming are often higher than in conventional farming. This is due to the use of more expensive inputs, increased need for mechanical or labour input, and lower yields. Because of higher production costs, and despite higher selling prices for organic products, farmers are sometimes unable to cover all their production costs.

Farmers are willing to seek out technologies from all over the world to help them make their farms more profitable and get the most out of their work. The long-term profitability of the organic sector will depend on farmers' ability to supply quality products at a price acceptable to the customer.

Laser weeding (Credit : KULT-Kress)

Monarch tractor (Credit : Monarch)

In Conclusion

The French agricultural market is in the throes of change, gradually adopting new technologies to meet contemporary challenges. The trend towards the adoption of these innovations is visible, driven by the need to increase efficiency, reduce environmental impact and ensure the sustainability of the agricultural sector.

Growers are increasingly open to integrating technologies to optimize yields and minimize input use. This move towards smarter, more sustainable farming practices reflects France's commitment to remaining competitive in the global marketplace, while meeting growing expectations in terms of product quality and respect for the environment. These technological advances, combined with increased support from public policy and close collaboration between agricultural players, are shaping a French agricultural landscape resolutely focused on innovation and sustainability.

Do you have any other questions? Please contact me on my socials :

WANT TO LEARN MORE ABOUT OTHER MARKETS AND AGTECH OPPORTUNITIES ?

AMERICAN MARKET - 🇺🇸

AUSTRALIAN MARKET - 🇦🇺

CALIFORNIAN MARKET - 🇺🇸

CANADIAN MARKET - 🇨🇦

EUROPEAN MARKET - 🇪🇺

FRENCH MARKET - 🇫🇷