International opportunities : AGTECH DEVELOPMENT ON THE AmERICAN AGRICULTURAL MARKETs

After studying the California State and its various markets, we now turn to the rest of the American market. Several weeks of research, reading and study were necessary to better understand this market and extract key data that explain its evolution. Here is the sharing of a part of my researches that focused on harvested crops

Today, we are going to see why this market is huge, both in terms of the size of its operations and the many opportunities that exist.

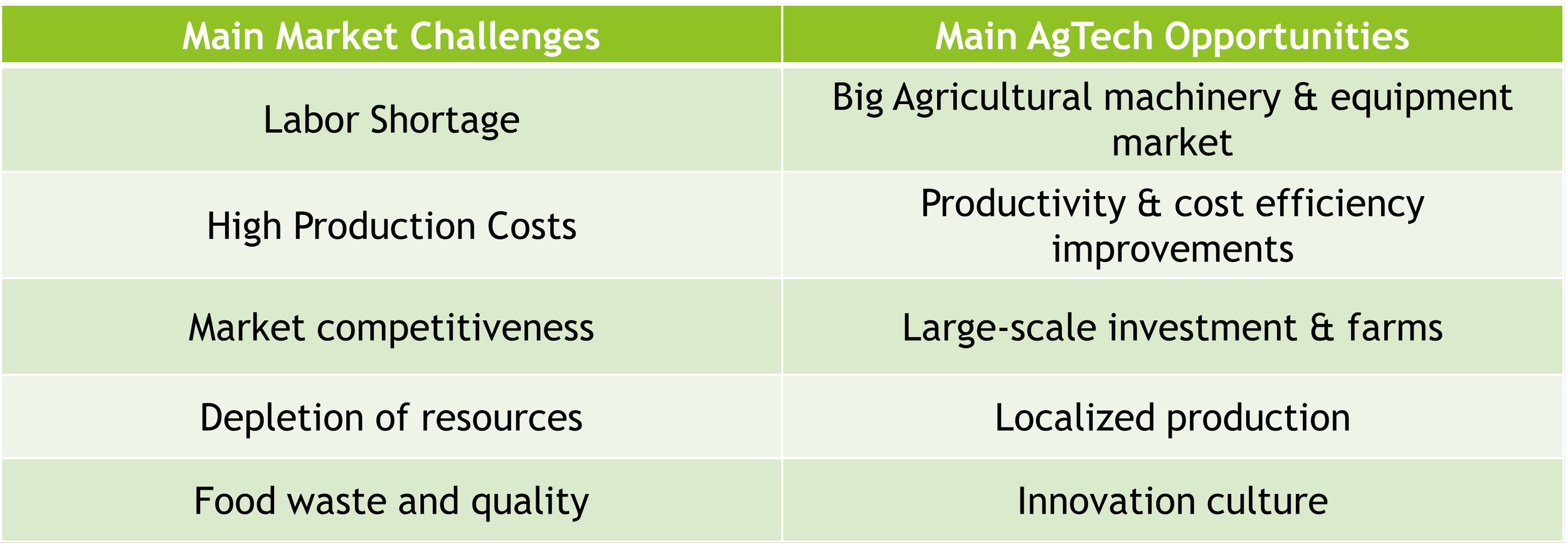

USA farming SUmmary : Challenges and opportunities for AgTECH

A huge Market diversity

Nothing better than a few figures to understand the size of the market:

🥦+ 1,000,000 ha of vegetables growing

🍇+ 370,000 ha of wine growing

🍏+ 2,000,000 ha of orchards growing

🍓+ 100,000 ha of berries growing

🌽+ 120,000,000 ha of field crops growing

🍅+ 110,000,000 m² of greenhouses

🌱+ 1,000,000 ha in organic production

↓ More figures and details on crop types by category in this report ↓

A growing agricultural machinery and equipment market

The United States and Canada represent 21% of the total market for agricultural machinery in the world. In 2021, this global market represented 160 billion US$, and in 2028 it is estimated that it will reach 170 billion US$.

In 2017, the 2 million U.S. farms had an average machine fleet value of $134,000, $20,000 more than in 2012. Rising farm labor costs, labor shortages, and increasing average farm size are the three main factors driving the farm machinery market in the country.

Huge farms

The average size of an American farm is 180 ha, which places the United States in the top 5 countries with the largest area per farm in the World.

To better understand the farm distribution, I took a closer look at the organization of farms that grow all types of crops, a case study including 1,245,000 farms in the US.

Number of farms per farm size

While almost half of the farms are less than 40 ha and only 21% are larger than 200 ha, when we look at the surface area represented by each of these categories, we get the complete opposite.

Area distribution per farm size

Farms of less than 40 ha represent only 3% of the total cultivated area. At the same time, farms of more than 200 ha, hold 81% of the total area.

labor status

This challenge was previously discussed in the California study. According to an official survey conducted in 2019, California farmers have adopted various farm mechanization technologies to overcome the labor problem. More than 40% of farmers have faced a labor shortage over the past five years, leading to farm mechanization in the state.

As we can see, California is just one example. Many states are struggling to find labor to work in the fields. As a result, labor is becoming more and more expensive and is taking an increasing share of farmers' production costs, and it will increase in the coming years.

For the most labor-intensive crops, farm mechanization has already offset the first waves of labor cost increases. Unfortunately for U.S. growers, it is difficult to know how much wages will increase. Will the automation of certain tasks be able to compensate for the increasing labor shortage ?

A Market Driven by Innovations and competitiveness

The lack of manpower is a global challenge faced by the entire American market, but there are other challenges that depend on the geography. Indeed, each state has its own challenges, whether economic, agronomic, environmental, political, social etc...

More generally, no matter where you are in the U.S., the race for competitiveness is the factor that dictates the evolution of the American agricultural market : farms are becoming fewer and larger, more and more sophisticated and large machinery to compensate for increasingly expensive labor, organic market is also developping fast to meet a growing demand and open new markets with more added value.

The U.S. agricultural machinery market is well established and dominated by giants such as John Deere and Company, AGCO Corp. and CNH Industrial N.V. etc. However, every innovation that can improve the productivity or profitability of an operation, will always find a place in this huge market, and the possibilities for improvement are numerous.

USA. Photo by Mark Stebnicki

In conclusion

We have just seen that the US market is in constant evolution, always looking for innovations that will allow it to remain competitive in the long term. The American culture makes change, investment and improvement a top priority, a matter of survival for their operation. The immensity of this market, its operations and diversity offer many opportunities for new agricultural technologies, as long as they actually make an improvement.

Does my product have potential in the US market? Is my product ready for this market ? Which state and market should I focus on first? What are the biggest differences between my current markets and the US market?

Want to learn more about markets and AgTech opportunities ?

AMERICAN MARKET - 🇺🇸

AUSTRALIAN MARKET - 🇦🇺

CALIFORNIAN MARKET - 🇺🇸

CANADIAN MARKET - 🇨🇦

EUROPEAN MARKET - 🇪🇺

FRENCH MARKET - 🇫🇷