EUROPEAN AGRICULTURAL MARKETS : AGTECH OPPORTUNITIES

“A market looking for new sustainable technologies”

With more than 400 billion euros revenue, the European Union is the world's leading agricultural power. After studying the United States, Canada and Australia, Agtech Market highlights the technological opportunities in European markets. In this article, we will highlight the specificities of this market, the challenges it faces and the opportunities that are open to new technologies.

But first, what is European from this analysis perspective ? In this ariticle, I have consider the 27 countries from the European Union, and additonnaly Switzerland, UK and Norway.

Photo from the family farm, Harvest 2022.

Founded in 2022, AgTech Market specializes in bridging the gap between agricultural innovation and real-world application. We help agricultural machinery manufacturers adapt to evolving AgTech trends by providing tailored support, from market analysis to product development and go-to-market strategies. Our mission is to make AgTech solutions accessible and effective, driving the adoption of technologies that truly meet the needs of farmers and manufacturers alike.

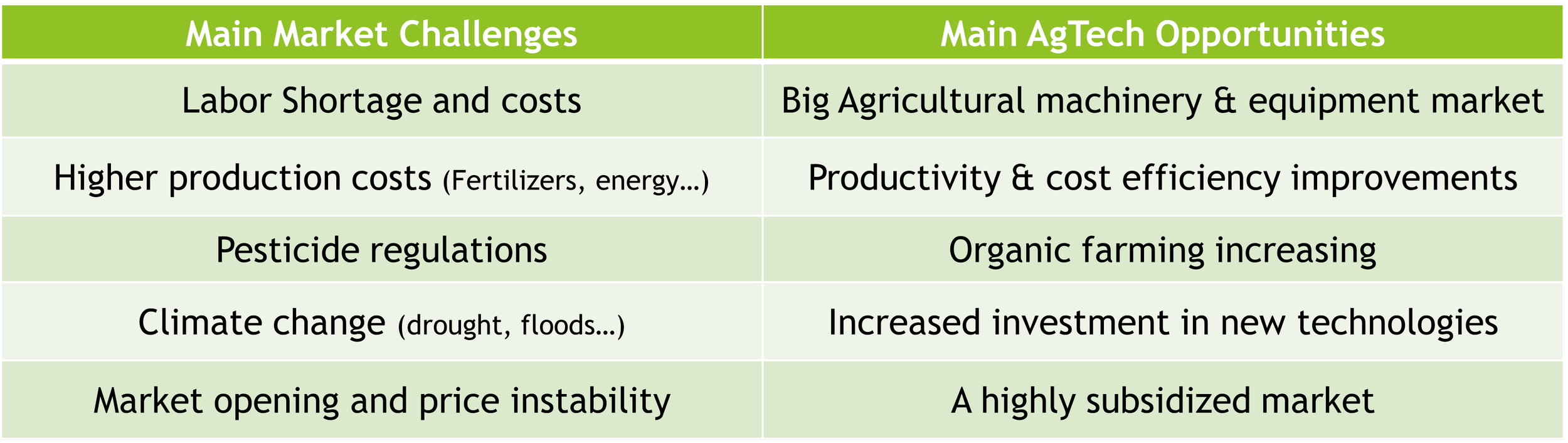

European market : Challenge and opportunities for agtech

The European agricultural market

Nothing better than a few figures to understand how big and diversify is the European market:

🥦 + 2,400,000 ha of vegetables growing

🍇+ 3,200,000 ha of wine growing

🍏+ 8,200,000 ha of orchards growing

🍓+ 240,000 ha of berries growing

🌽+ 70,000,000 ha of field crops growing

🍅+ 100,000 ha of greenhouses

↓ More figures and details on key crop types by category in this report ↓

The European agriculturals markets and their opportunities

Evolution of European agriculture

European Farms distribution

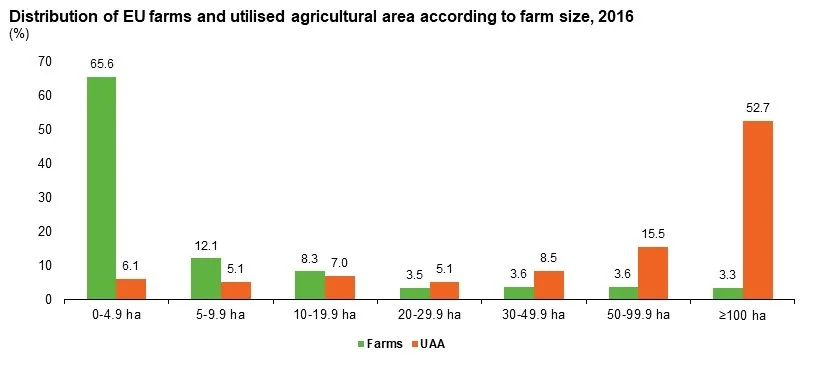

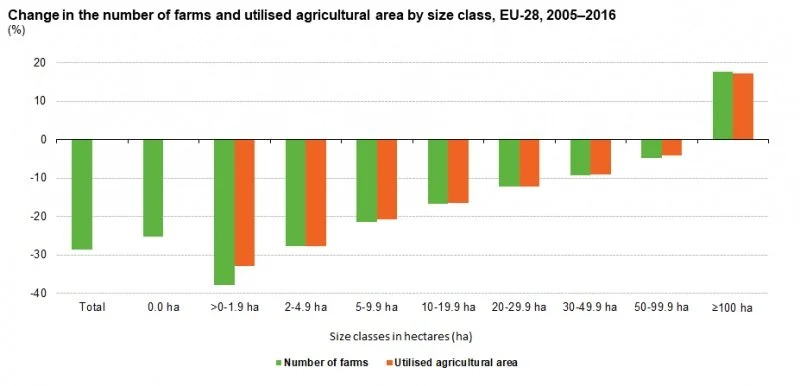

The history of European agriculture means that farms are smaller than the younger markets like Austalia, Canada or America. However we can see that the trends are the same, the number of farmers is decreasing and the agricultural surface per farm is increasing.

Distribution of Land and holding per size, eurostat

Holding and agriculture land evolution , eurostat

The number one market in organic farming

In 2022, 8.5% of the European agricultural surface is dedicated to organic farming. Since the year 2000, the total surface has been multiplied by 6 and now France, Italy, Spain and Germany represent 65% of this surface.

Organic Farming area, eurostat

Organic farming area per European country, eurostat

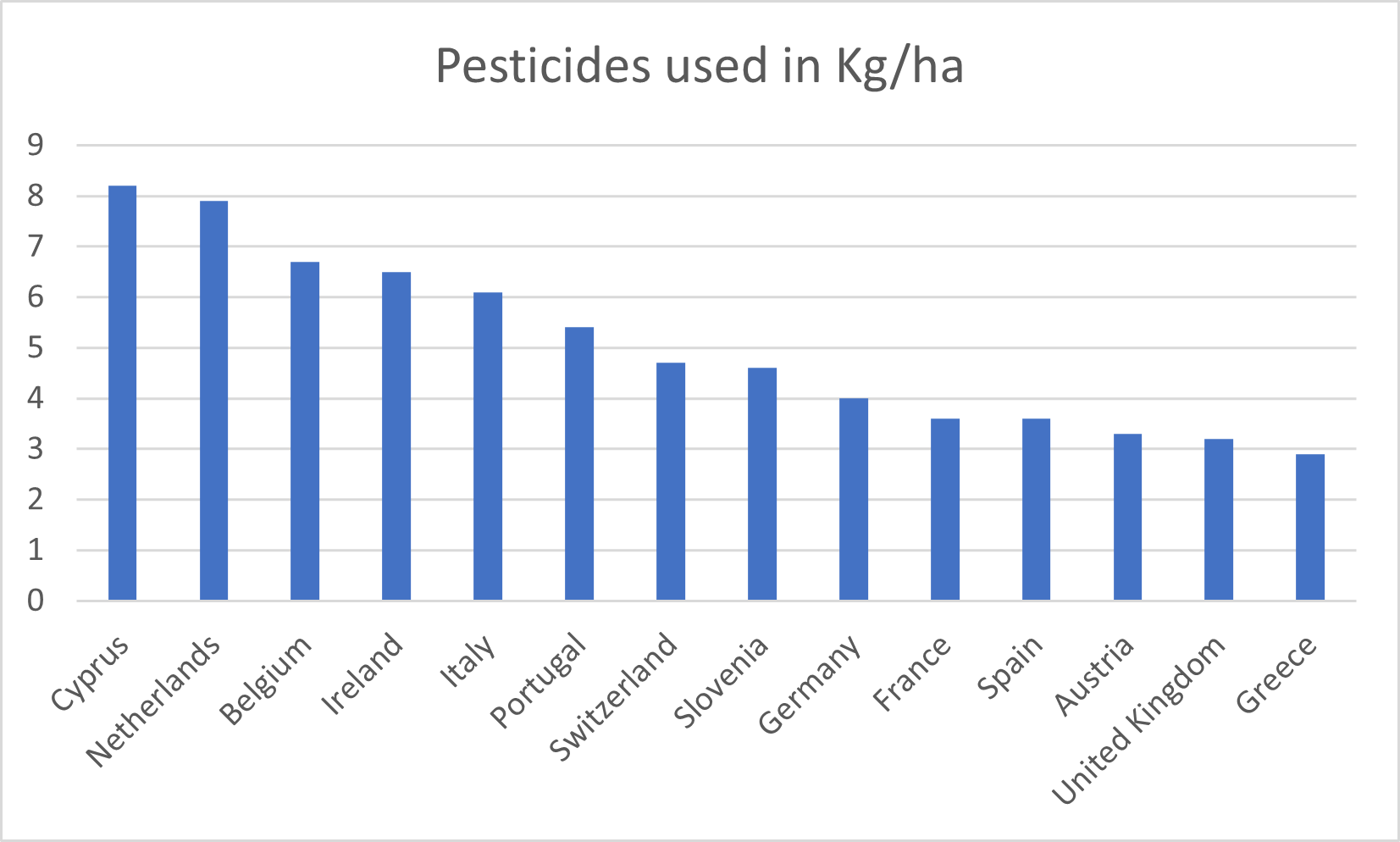

One of the big challenges of this production will be to grow industrial quality products while keeping yields and production costs close to conventional. Pesticides alternatives, spot spraying technologies and all other precision farming technologies will have their role to play in this transition.

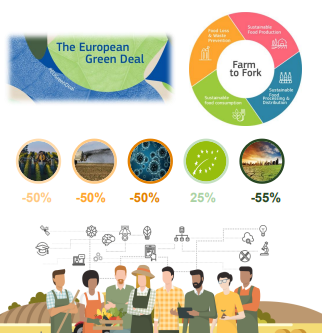

2030, Reduce pesticide consumption by 50% in Europe

The European Commission proposes to reduce the use of chemical pesticides and their associated risks by 50% by 2030. EU member states used an average of 3.13 kg of pesticides per hectare of cultivated land. A figure that, while it has almost not changed in over 30 years. However, the consumption per country is not as homogeneous as one might think.

Pesticides ration kg/ha of farming land per country, AgTech Market

Total pesticides used per country, AgTech Market

European Labour shortage opportunity for agtech

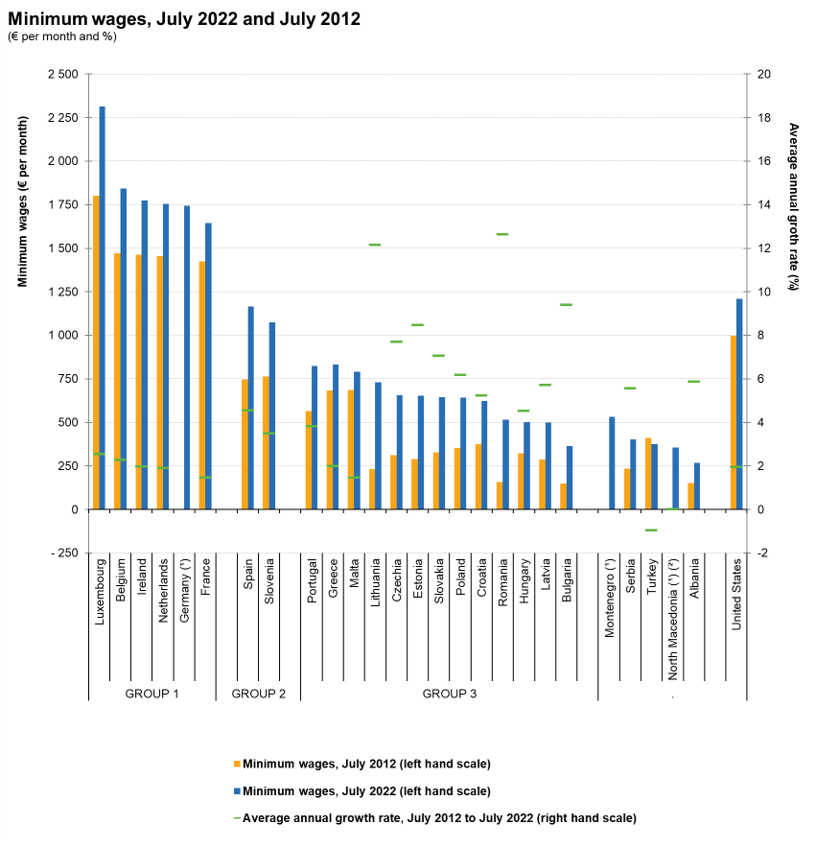

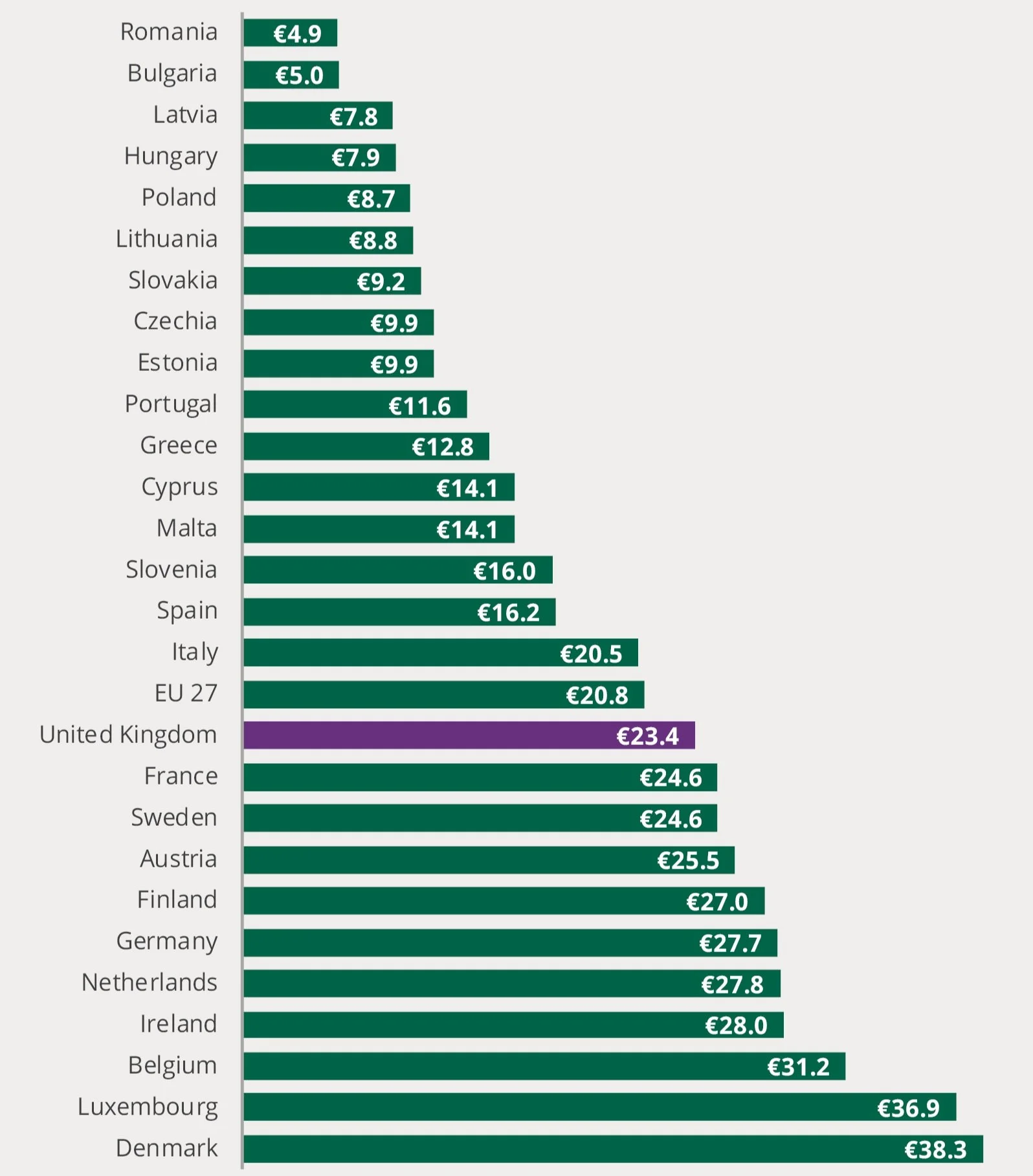

Once again, there is a great disparity within Europe itself with regard to the workforce. Even though for all European countries, the minimum wage has increased in the last 10 years. For some countries, there is an annual increase of 10-15%, while for countries that already had a high minimum wage, there is an annual increase of 2-5% in the last 10 years.

Beyond the increasing cost, it is especially the agricultural workforce that is becoming scarce in Western Europe, the countries then call for a cheaper workforce from Eastern Europe or Africa.

Minimum wage evolution per country, Eurostat

Average wage per country, UK Parliament

Technologies that improve productivity or robotization solutions are the solutions considered to overcome this lack of manpower in the European market.

Evolution of the European Farms costs

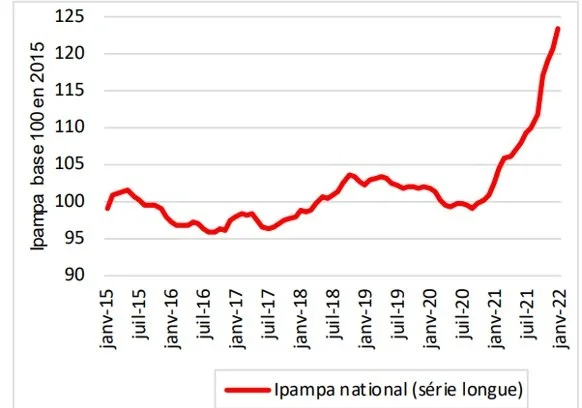

The after-COVID period and the war in Ukraine have had a strong impact on European agriculture. With the increase cost for chemical fertilizers and energy, farms have been directly impacted. The agricultural equipment has also taken a lot of inflation due to an increase in raw material and delivery times.

Evolution of the PPIAI index

The purchase price index for agricultural inputs (PPIAI) measures the variations in purchase prices borne by farms for their production inputs and investment expenses.

The increase of these costs has an impact direct impact on the production costs. If the crisis persists or intensifies, the new solutions such alternative to chemical fertilizers, alternative to thermal vehicles, precision and farm management technologies will be adapted more quickly

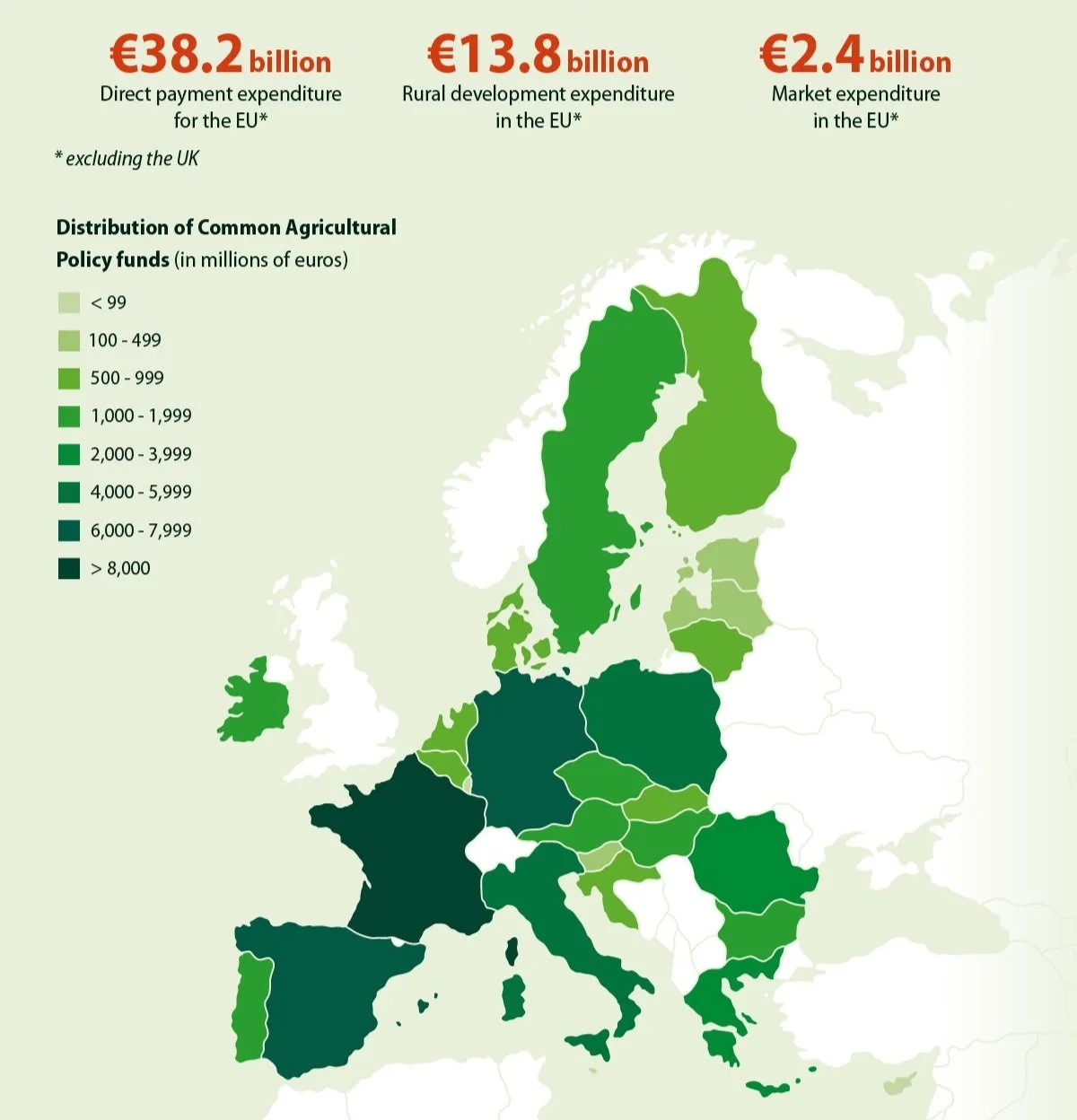

A highly subsidized market

Agriculture is the only sector fully financed by the EU budget. With 62.5 billion euros distributed to the 27 member states, this represent around 40% of the European Union's budget that is spent on agriculture. The main grant is the Common Agricultural Policy (CAP) and it is the addition of two programs. The European Agricultural Guarantee Fund (EAGF),primarily finances direct payments and measures regulating or supporting agricultural markets and the European Agricultural Fund for Rural Development (EAFRD) finances the EU's contribution to rural development programmes.

The Common Agricultural Policy (CAP)

Farmers generally receive income support based on their farm’s size in hectares. All EU countries have to offer a basic payment, a payment for sustainable farming methods and a payment for young farmers.

Additionally, EU countries can choose to offer other payments that focus on specific sectors or types of farming, like organic. There are specific schemes designed to help small and medium sized farms, young farmers, farmers who operate in areas of natural constraint and/or sectors undergoing difficulties.

Horizon Europe program for 2021-2027

This program is the ambitious EU research & innovation framework with a budget of €95.5 billion. The main challenges for agriculture are :

Reduce by 50% the overall use and risk of chemical pesticides and reduce use by 50% of more hazardous pesticides

Reduce nutrient losses by at least 50% while ensuring no deterioration in soil fertility

Reduce sales of antimicrobials for farmed animals and in aquaculture by 50%

Get 25% of the EU’s agricultural land under organic farming and increasing in organic aquaculture

These grants may very well apply to farm equipment that complements any of these characteristics. On a national scale, other investment grants are envisaged by this scheme are intended to support the development of more environmentally friendly agricultural practices.

In Conclusion

European market is searching for innovative solutions to build a more sustainable agriculture. Whether it is drones, robots, electrical tractors, farm management or spot spraying technologies, the European market is the perfect playground for any more sustainable and more efficient AgTech solutions.

The European markets interests you ? Would you like to have a targeted, relevant and customized analysis or data base ? Would you like to have a feedback on your technology, from customers, product and field experts ?

WANT TO LEARN MORE ABOUT OTHER MARKETS AND AGTECH OPPORTUNITIES ?

AMERICAN MARKET - 🇺🇸

AUSTRALIAN MARKET - 🇦🇺

CALIFORNIAN MARKET - 🇺🇸

CANADIAN MARKET - 🇨🇦

EUROPEAN MARKET - 🇪🇺

FRENCH MARKET - 🇫🇷